The American art market is holding up well

[13 Jun 2023]After our overview of the French art market (see our article French art market: end of the post-covid rebound effect) which notes a sharp contraction in auction turnover at the leading art auctioneers since the beginning of the year (-38% for Christie’s France and -68% for Artcurial), Artprice by Artmarket takes a quick look at the art auction figures in the world’s largest national art market, the United States, between 1 January and 15 May 2023.

In a particularly complicated global context since the Covid crisis, the war in Ukraine, the energy crisis, and the cost of living crisis, the art market has seemed quite impervious to the ambient turbulence and has played its role as a safe haven over the past three years, attracting more and more new collectors in mainland China, South Korea, Africa, and reaching new price peaks following the appearance of rare works on the American market.

Following the splendors of 2022…

Last year the auction houses offered an incomparable abundance of works, including absolute masterpieces from leading private collections. In the spring, New York’s May sales generated spectacular results culminating in the dispersions of the Anne H. Bass and Thomas & Doris Ammann collections, and in the fall, a flurry of historic results from the Paul G. Allen Collection totalled over $1.6 billion. In short, 2022 was a truly exceptional year.

But, after Christie’s extraordinary successes last year, May 2023 has proved to be much calmer for the world’s leading art auctioneer with auction turnover revenue down 38.8% for the reference period (1 January and 15 May 2023) compared with the year-earlier period. The best works offered this year have not been as desirable as those that fueled last year’s prestige sales and Christie’s turnover contraction is essentially due to the absence of a handful of rare masterpieces with superb pedigrees. From a market perspective, this is not worrying per se, as the market knows it is difficult to obtain such auspicious windfalls from one year to the next.

Last year, Christie’s generated one and a half billion dollars between January and May, with over $1 billion hammered in the single week of its prestige May sales thanks to several museum quality paintings from the Bass collection, as well as a work by Warhol from the Ammann collection, Shot Sage Blue Marilyn, which fetched $195 million. This huge result alone represented 12.57% of Christie’s New York takings for the first five months of 2022.

This year, Christie’s best result has been for a canvas by Jean-Michel Basquiat which fetched $67 million on 15 May 2023 (The Great Show (The Nile),1983). Monsieur Pinault’s company has also hammered four results above $30 million – including a new record for Le Douanier Rousseau at $43.5 million (Flamingos), while Sotheby’s current year-best is $26.9 million for a flamboyant work by Rubens.

Six results above the $50 million threshold hammered in May 2022 versus only one in 2023 (for a work by Basquiat)

$195,040,000: Andy Warhol, Shot Sage Blue Marilyn – 1964

Christie’s, New York, 09/05/2022. The Collection of Thomas and Doris Ammann Evening Sale

$75,960,000: Claude Monet, Le Parlement, soleil couchant – 1900-1903

Christie’s, New York, 12/05/2022. The Collection of Anne H. Bass

$66,800,000: Mark Rothko, Untitled (Shades of Red) – 1961

Christie’s, New York, 12/05/2022. The Collection of Anne H. Bass

$56,495,000: Claude Monet, Nymphéas – 1907

Christie’s, New York, 12/05/2022. The Collection of Anne H. Bass

$54,205,000

Jackson Pollock, Number 31 – 1949

Christie’s, New York, 12/05/2022

$51,915,000: Vincent van Gogh, Champs près des Alpilles – 1889

Christie’s, New York, 12/05/2022 (which passed through the Yves Saint Laurent and Pierre Bergé collection, Paris)

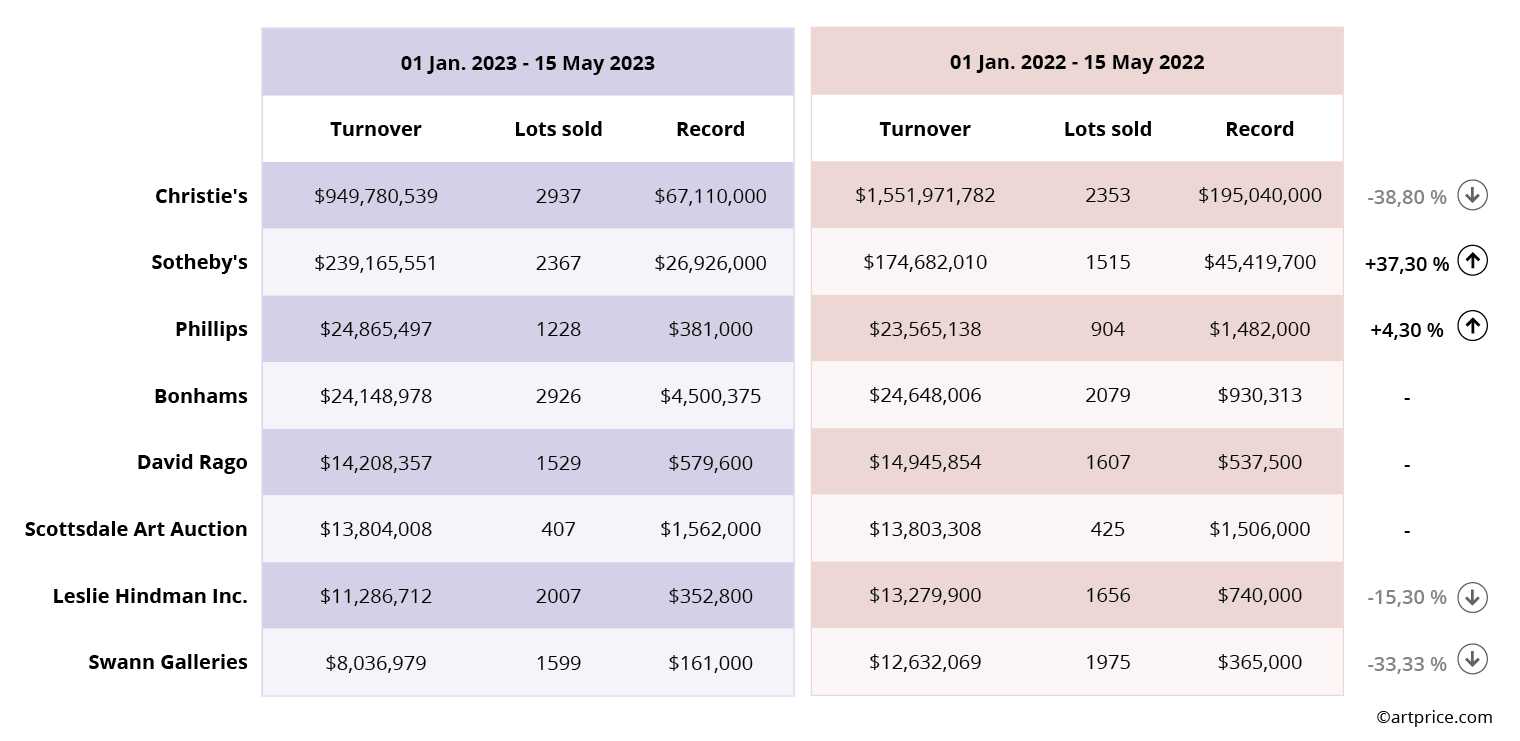

Although Christie’s NY is $600 million short of the results it achieved last year, its performance of close to $950 million this year is no less exceptional when compared with the $239 million posted by its direct competitor, Sotheby’s US, over the same period. Sotheby’s has nevertheless recorded a remarkable growth rate of around 37% in its turnover compared to last year. The turnover total is also up slightly at Phillips US from $23.5 million to $24.8 million, while Bonhams, David Rago et Scottsdale Art Auction have all posted results in line with those of last year. The base of the American market therefore remains solid and the vast majority of works of prime importance – those by Rothko, Picasso, Morandi, Klimt, Gauguin, etc. – have found takers within their estimated ranges… when they have not exceeded them.

Auction turnover in the United States by auction house (copyright Artprice.com)

0

0